BRIEF FROM THE CANADIAN TRUCKING ALLIANCE

Canadian Trucking Alliance:

· Federation of all of Canada’s provincial trucking associations.

· Representing over 4,500 motor carriers.

· Most are small, family-owned establishments.

Trucking Industry:

· Handles 90% of consumer products and foodstuffs.

· Two-thirds of Canada-US trade.

· Service is what distinguishes trucking from other modes.

· No other mode able to provide time-sensitive, door-to-door service to every community, business and individual in the country.

· Employs an estimated 388,000 workers.

· In 2010 contributed almost $17 billion to Canada’s GDP - more than air, rail and marine transportation combined.

Trucking as a Leading Economic Indicator

· Canadian trucking industry is emerging from recession which saw drop in volumes of about 30%.

· Domestic economy has rebounded impressively but the outlook remains cloudy due to an uncertain economic outlook for the US, the high value of the Canadian dollar and escalating fuel prices.

· Southbound shipments to the United States, the industry’s major market and source of growth for over 20 years, remain very weak.

· Cross-border truck trips remain well below pre-recession numbers.

· This creates challenges for equipment utilization and profitability.

· Freight rates continue to lag behind the pick-up in economic activity.

· Combined with economic uncertainty , tight access to capital has led to a drag on investment in new equipment. As a result, fleet is aging when carriers should be replacing older vehicles and investing in GHG compliant trucks and aftermarket devices to reduce GHG from the existing fleet.

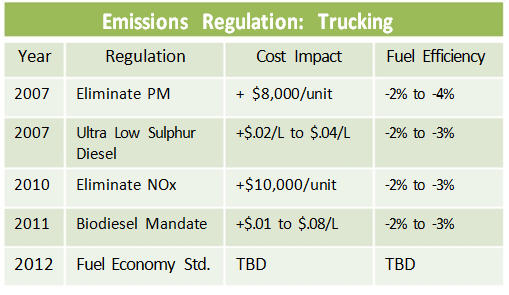

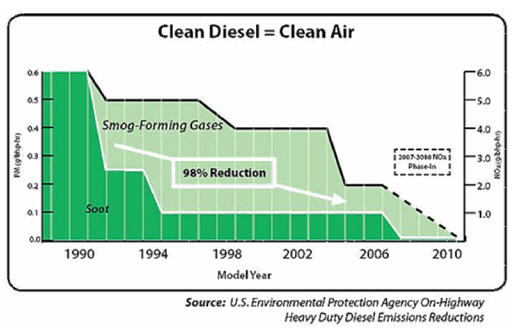

Impact of Emissions Regulations

· Few if any other industries -certainly not in transport sector -- subject to such a high level of emissions regulation.

· Focus has been on eliminating emissions that contribute to smog (PM, NOx).

· Since 2010 all new engines are smog free.

· However has come at a cost – higher purchase price, more costly to maintain AND fuel efficiency penalty.

· New biodiesel mandate will exacerbate situation: increase price of fuel, reduce fuel economy and increase maintenance costs.

· Environment Canada now turning attention to GHG emissions from heavy trucks which is almost entirely function of fuel consumption.

· NRTEE report (2007) said improving truck fuel efficiency is second largest single GHG reduction opportunity for Canada after carbon capture & sequestration.

· So while federal air quality regulations are driving fuel consumption up, federal government preparing fuel economy regulation.

· However, regulation will focus only on the tractor and engine where limited gains in fuel economy can be realized.

Why The Time Is Right

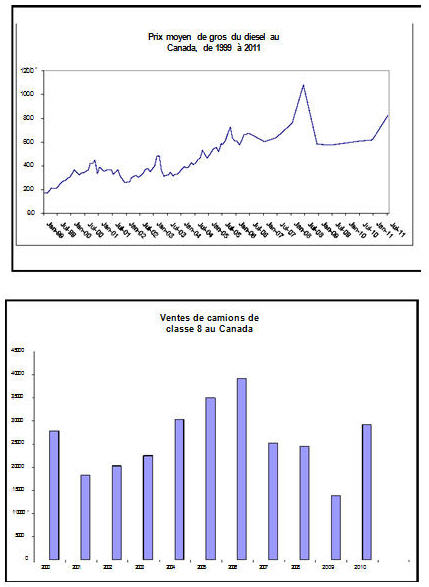

Fuel Costs Climbing

· Fuel 2nd largest component of cost.

· Wholesale diesel prices up 35% year-over-year.

· Approaching 2008 levels when Prime Minister promised to reduce excise tax on diesel fuel by 50%.

Fleets Need to Re‐Tool

· During recession truck sales plummeted.

· Carriers delayed re-tooling of fleet, extended age of fleet and glut of used equipment.

· Economic uncertainty, lag in rates, tight access to capital continue to be a drag on investment.

· Sales of new trucks have begun to pick-up but replacement only.

Government-Industry Interests Are Aligned

· If ever there was a time to incent carriers to make choices consistent with government environmental objectives, it is now.

· Canada wants to meet GHG targets.

· Industry needs to recoup fuel economy loss from emissions regulation/biodiesel mandate.

· Proposed fuel economy standard for heavy trucks a start but will have only limited impact; new tractors and engines only and truck buyers will not be compelled to purchase trucks that meet GHG regulatory standards. They will still have choice.

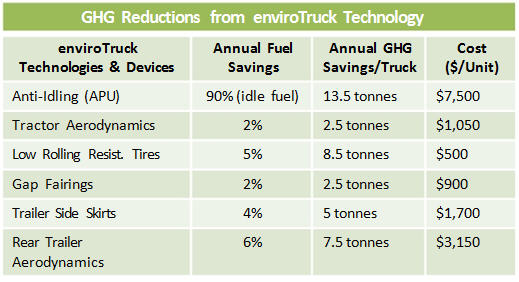

What Can Be Achieved?

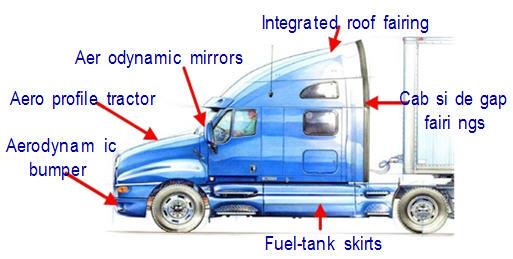

· CTA enviroTruck initiative marries mandated new, smog-free truck engines with proven technologies and devices for tractors and trailers to improve fuel efficiency and therefore reduce GHGs.

· Consistent with USEPA Smartway.

· If Canadian fleet (300,000 Class 8 trucks) adopted full package , fuel consumption reduced by 4.1 billion litres and GHG reduced by 11.5 million tonnes each year.

· Equivalent to taking 2.6 million cars or 90,000 trucks off the road.

· Another way to look at it: Two trucks travelling Vancouver to Toronto (4,400 km) - one equipped with enviroTruck devices yielding 17% fuel savings. The one without these devices would run out of fuel around Wawa, ON -- 750 km short of Toronto. enviroTruck would make it all the way.

· Payback over time but upfront costs.

· Environmental premium for new tractors, lack of financing especially for retrofits.

How It Can Be Achieved

1. Purchase of New “GHG Compliant” Tractors

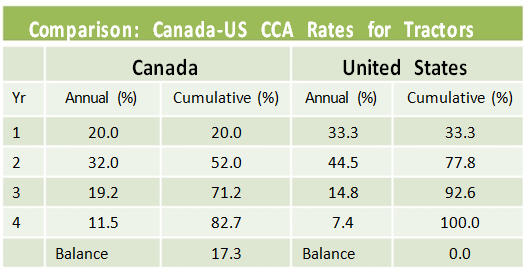

· Canadian CCA rates for new tractors should be Comparison: Canada-US CCA Rates for Tractors accelerated to quicken fleet turnover and incent purchase of heavy trucks which meet the new GHG standard .

· US carriers will have same GHG standard but can write off tractor in 4 years; in Canada tractors are 8 year asset.

· 2008 budget accelerated CCA rates for railways to assist with proposed locomotive emission regulations.

· Manufacturers receive one-year depreciation for environmental technology.

· Why has trucking - already complying with tough engine, fuel standards - not received similar consideration?

· Include alternative propulsion systems (e.g., electric hybrids, liquefied natural gas, etc.) , which are ready for prime time.

· Quebec has accelerated CCA rates for tractors to 60%, and trucks powered by Liquified Natural Gas (LNG) to 85% on top of that.

2. Retrofit Existing Fleet (Tractors AND Trailers)

· Time-limited, retrofit program for equipping existing fleet of tractor-trailers with designated aftermarket fuel efficiency technologies and devices.

· Complement heavy-truck GHG regulation (will cover new tractors only).

· Use USEPA Smartway designation for eligibility.

· Program would comprise rebates/grants.

Where the Rubber Hits the Road

Mindful of Fiscal Constraints

· Now is not the time to be recommending new, expensive measures.

· Recommendations will have little impact on federal finances, but tremendous GHG reduction impact and support Canadian manufacturers of the technology.

CCA Rate Acceleration Limited in Scope

· CCA rate acceleration will be for new “GHG compliant” tractors only - not all new tractors and not for existing fleet.

Paying for a Retrofit Program

· Previous experience suggests significant payback to society for modest investment.

· Previous NRCAN program for auxiliary power units (APUs) had rebate of 20% of cost and generated $31 million in private investment for $6 million in government spending.

· In addition, commitment was made by Prime Minister in 2008 to cut the 4 cent/litre diesel excise tax in half.

· Instead, CTA receptive to using revenues to fund retrofit program.

· Excise tax on diesel generates about $1 billion per year in revenue. Truckers pay lion’s share. 50% reduction yields $500 million. If half devoted to rebate program $250 million would be available.